How do lenders determine how much to lend

The majority of lenders demand that you will spend less than 28 percent of your income before taxes on housing and that you will spend no more than 36 percent of your. Lenders provide an annual interest rate for mortgages.

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates

You can calculate your total interest by using this formula.

. Some lenders are much more strict than others when it comes to affordability and debt so its important for you to find a lender whos more lenient. Ad We mean it when we say it. Traditionally mortgage lenders applied a multiple of your income to decide how much you could borrow.

Additionally the lender will need to calculate each loan rate at 5 of the outstanding balance divided by 12 months example. Lenders use this measurement to ensure that youll have enough income to cover both your. If you want to do the monthly mortgage payment calculation by hand youll need the monthly interest rate just.

LVR is calculated by comparing how much is being borrowed against the total value of the property. Contact a Loan Specialist to Get a Personalized FHA Loan Quote. Savings Include Low Down Payment.

For example say you receive an advance of 50000 with a factor rate of 14 that you anticipate repaying over six months. This can include the following data. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You.

Principal loan amount x Interest rate x Time aka Number of years in term. The Best Offers from BBB A Accredited Companies. 25000 student loan balance x 5 1250 divided by 12.

So in simplistic terms if the property is worth 500000 and you have a 400000. Lenders like NetCredit consider a variety of factors from your credit history when determining loan offers. Online lending made simple.

Click Now Apply Online. Percentage Of Gross Monthly Income Many lenders follow the rule that your monthly. Mortgage lenders will typically use two ratios as part of the loan approval process.

A 20 down payment makes a lender feel much more secure than a 10 down payment. Here Are Some of The Common Ways That Mortgage Lenders Determine How Much You Can Borrow. You obtain the Upfront Mortgage.

Fast Easy Approval. How do you calculate interest rate on a home loan. So if you earn 30000 per year and the lender will lend four times.

Percentage of Gross Monthly Income Ideally your monthly mortgage. To calculate how much you can expect to pay for your total loan get the Upfront Mortgage Insurance rate and add it to the base loan amount. So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial.

An agreement in principle also. The first is a ratio of estimated monthly housing expenses principal interest property taxes and. If a lender has a minimum credit score requirement it may be the first and only piece of due diligence they.

Here Are Some Of The Common Ways That Lenders Determine How Much You Can Borrow. Funding amount x factor rate Total amount owed. Lenders generally look for the ideal front-end ratio to be no more than 28 percent and the back-end ratio including all monthly debts to be no higher than 36 percent.

For many lenders credit history can be summed up simply with a FICO score. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. DTI Often Determines How Much a Lender Will Lend.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Ad Check Your FHA Mortgage Eligibility Today. Credit Score Credit score is another key factor in determining your interest rate.

One of the first factors a lender will analyze is your debt-to-income ratio or DTI.

29 Simple Family Loan Agreement Templates 100 Free Loan Agreement Creative Life Hacks

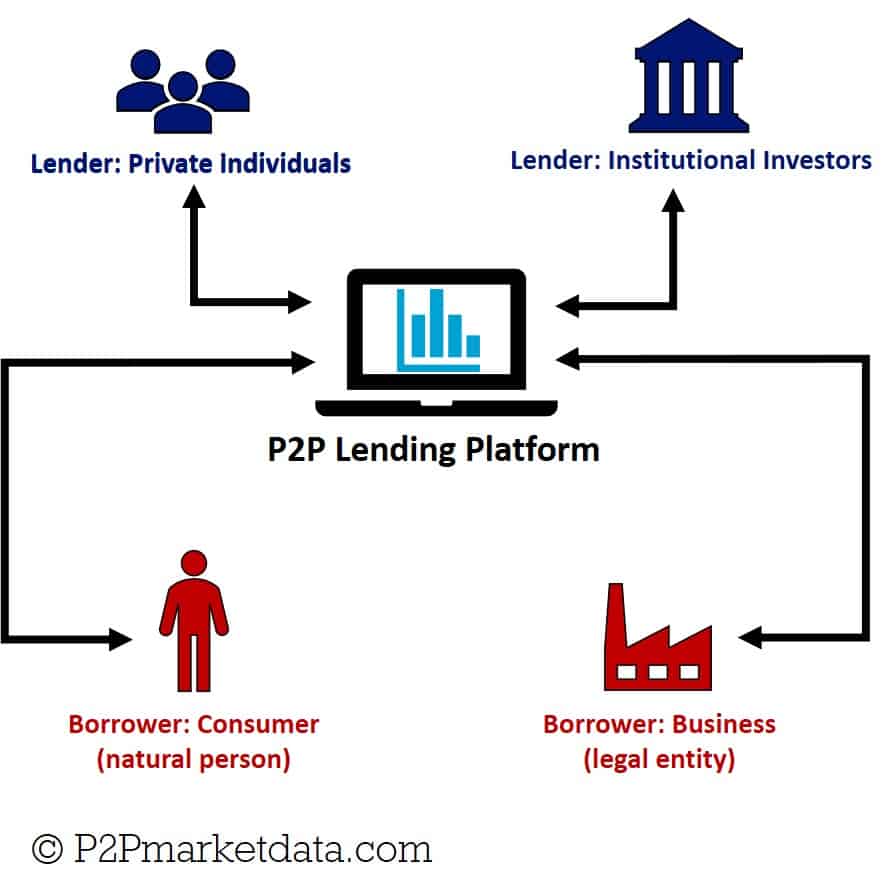

Peer To Peer Lending An Alternative Source Of Finance Peer To Peer Lending Money Management Advice Economics Lessons

Mortgage Loan Approval Process Explained The 6 Steps To Closing The Hbi Blog Mortgage Loans Mortgage Approval Mortgage Loan Originator

Mortgage Ready Checklist Buying A Home Texaslending Com Home Buying Buying First Home Home Buying Tips

Private Lending 101 Everything You Need To Know About Private Money Lending

Lending Money Contract Template Free Fresh Loan Agreement Letter Loan Contract And Agreement Contract Template Loan Lettering

A Close Examination Of The Risks And Rewards Of Securities Lending Morningstar

What Is Balance Sheet Lending And How Is It Different To P2p Lending

Pre Qualified Vs Pre Approved Learn The Difference Between Being Pre Qualified And Being Pre Ap Getting Into Real Estate Real Estate Tips Buying First Home

Loan To Value Ratio What Is It And How To Calculate It Mortgage Broker Store

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Loan Officer Vs Mortgage Broker What S The Difference

Family Loan Agreements Lending Money To Family Friends

What Do Banks Look For When Lending The 5 Cs Of Credit Ride Time

Log In Or Sign Up To View Real Estate Marketing Real Estate Houses Real Estate Broker

What Does Heloc Mean In Real Estate A Home Equity Line Of Credit Or Heloc Is A Lo Real Estate Marketing Quotes Real Estate Agent Marketing Real Estate Terms

Defi Lending And Borrowing Guide Yield App

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor